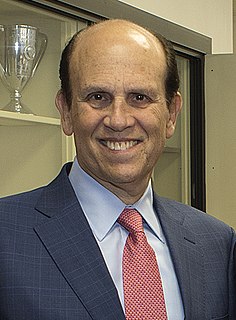

A Quote by Barry Ritholtz

When markets are rallying, cash in the portfolio is a drag on performance, returning about zero.

Related Quotes

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices.