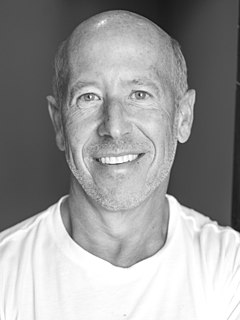

A Quote by Barry Sternlicht

You go public because you want access to capital in the form of debt and equity.

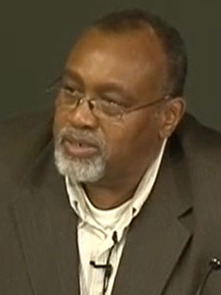

Related Quotes

Private equity capital in each of those markets Europe and Asia - while those markets have very different characteristics - fills a niche where either strategic investors or the public markets don't go, or don't want to go for some particular reason. I think that's going to continue to be the case going forward.

There are respectable individuals, who from a just aversion to an accumulation of Public debt, are unwilling to concede to it any kind of utility, who can discern no good to alleviate the ill with which they suppose it pregnant; who cannot be persuaded that it ought in any sense to be viewed as an increase of capital lest it should be inferred, that the more debt the more capital, the greater the burthens the greater the blessings of the community.

America is the only advanced industrial democracy where people can get sick and languish because they can't afford care. Or where people are blocked in access to the system because they don't have access to insurance, which is only available through certain narrow portals and under certain very restricted conditions. We're the only society that hasn't embraced this idea that no one should go without access to these services, regardless of their financial condition. And no one should be saddled with a lifetime of debt because they have the misfortune of falling ill.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.