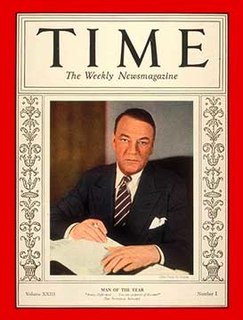

A Quote by Ben Bernanke

The Federal Reserve cannot solve all the economy's problems on its own.

Related Quotes

The real estate interests and banks are in a kind of symbiosis. They're the largest-growing part of the economy. This is the sector that backs the political campaigns of senators, presidents and congressmen, and they use this leverage to make sure that their people dominate the Federal Reserve, Treasury and the federal housing agencies.

And I've come to the place where I believe that there's no way to solve these problems, these issues - there's nothing that we can do that will solve the problems that we have and keep the peace, unless we solve it through God, unless we solve it in being our highest self. And that's a pretty tall order.

The problems of 2008 were never cured. The Federal Reserve's solution to the crisis was to lend the economy enough money to borrow its way out of debt. It thought that if it could subsidize banks lending homeowners enough money to buy houses from people who are defaulting, then the bank balance sheets would end up okay.