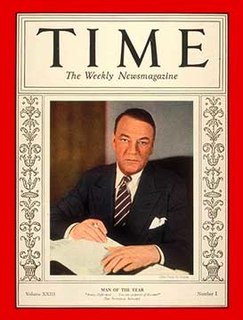

A Quote by Ben Bernanke

All the Federal Reserve can do is make loans against collateral.

Quote Topics

Related Quotes

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

When it comes to the Federal Reserve, there's an awful lot of books out there; in my library, I bet I've got 200 books if I've got any on the Federal Reserve. And we don't need any more books, we need action, and that's what the Liberty Dollar did, it gave people a way to take action. Our catch phrase was you want to "make money, do good, and have fun," and people really responded to that.