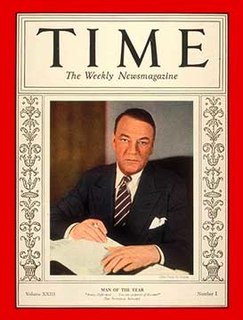

A Quote by Ben Bernanke

Fostering transparency and accountability at the Federal Reserve was one of my principal objectives when I became Chairman in February 2006.

Related Quotes

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

People in America get really angry at the Federal Reserve and at the "money system" in general during economic crises. The Fed draws hostility because of its power, its insulation from democratic accountability, its lack of transparency, and because of its historical and structural connections to finance.