A Quote by Ben Bernanke

The Federal Reserve has always recognized the importance of allowing markets to work, and government oversight of financial firms will never be fully effective without the aid of strong market discipline.

Related Quotes

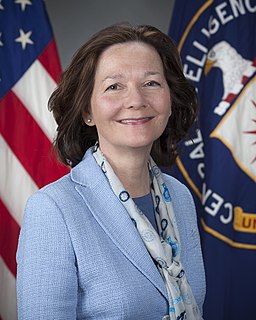

As both a career intelligence officer and as an American citizen, I am a strong believer in the importance of oversight. Simply put, experience has taught us that CIA cannot be effective without the people's trust, and we cannot hope to earn that trust without the accountability that comes with Congressional oversight.

Financial innovation can be highly dangerous, though almost no one will tell you this. New financial products are typically created for sunny days and are almost never stress-tested for stormy weather. Securitization is an area that almost perfectly fits this description; markets for securitized assets such as subprime mortgages completely collapsed in 2008 and have not fully recovered. Ironically, the government is eager to restore the securitization markets back to their pre-collapse stature.

California will not wait for our federal government to take strong action on global warming. We won't wait for the federal government. We will move forward because we know it's the right thing to do. We will lead on this issue and we will get other western states involved. I think there's not great leadership from the federal government when it comes to protecting the environment.

The tenth amendment said the federal government is supposed to only have powers that were explicitly given in the Constitution. I think the federal government's gone way beyond that. The Constitution never said that you could have a Federal Reserve that would have $2.8 trillion in assets. We've gotten out of control.