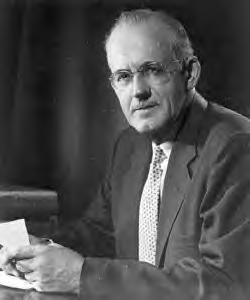

A Quote by Ben Bernanke

As we try to make the financial system safer, we must inevitably confront the problem of moral hazard.

Quote Topics

Related Quotes

Don't reward bad behavior. It is one of the first rules of parenting. During the financial cataclysm of 2008, we said it differently. When we bailed out banks that had created their own misfortune, we called it a 'moral hazard,' because the bailout absolved the bank's bad acts and created an incentive for it to make the same bad loans again.

The global financial crisis is a great opportunity to showcase and propagate both causal and moral institutional analysis. The crisis shows major flaws in the way the US financial system is regulated and, more importantly, in our political system, which is essentially a bazaar of legalized bribery where financial institutions can buy themselves the governmental regulations they want, along with the regulators who routinely receive lucrative jobs in the industry whose oversight had formerly been their responsibility, the so-called revolving-door practice.

Fear, coercion, punishment, are the masculine remedies for moral weakness, but statistics show their failure for centuries. Why not change the system and try the education of the moral and intellectual faculties, cheerful surroundings, inspiring influences? Everything in our present system tends to lower the physical vitality, the self-respect, the moral tone, and to harden instead of reforming the criminal.

I believe that the financial crisis of 2008/9 exposed more a lack of ethics and morality - especially by the financial sector - rather than a problem of regulation or criminality. There were, of course, regulatory lessons to be learned, but at heart, there was a collective loss of our moral compass.