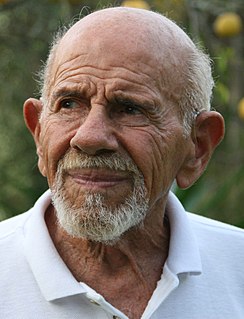

A Quote by Ben Bernanke

The best approach here, if at all possible, is to use supervisory and regulatory methods to restrain undue risk-taking and to make sure the system is resilient in case an asset-price bubble bursts in the future.

Related Quotes

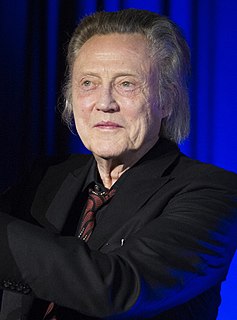

What we define as a bubble is any kind of debt-fueled asset inflation where the cash flow generated by the asset itself - a rental property, office building, condo - does not cover the debt incurred to buy the asset. So you depend on a greater fool, if you will, to come in and buy at a higher price.

The enthusiasm for Tesla and other bubble-basket stocks is reminiscent of the March 2000 dot-com bubble. As was the case then, the bulls rejected conventional valuation methods for a handful of stocks that seemingly could only go up. While we don't know exactly when the bubble will pop, it eventually will.

In my work, I am not attempting to predict the future. I am only pointing out what is possible with the intelligent application and humane use of science and technology. This does not call for scientists to manage society. What I suggest is applying the methods of science to the social system for the benefit of human kind and the environment.

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.