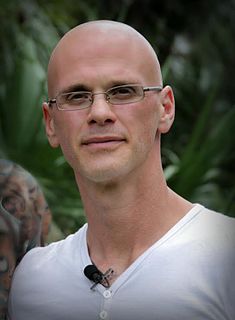

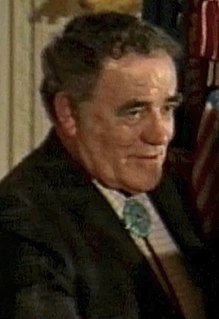

A Quote by Ben Bernanke

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

Quote Topics

Any

Bank

Become

Been

Case

Central

Central Bank

Challenges

Collapse

Consumer

Decline

Denying

Economic

Economic Growth

Economy

Effects

Financial

Foreign

Growth

History

However

Investors

Less

Levels

Magnet

Market

Pose

Prices

Protect

Proves

Recently

Sector

Serious

Side

Side Effects

Slow

Smart

Somewhat

Spending

States

Stock

Stock Market

Stock Price

Today

United

United States

Unsustainable

Which

Would

Would Be

Related Quotes

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

Every country in the world protects its economy except the E.U. We would restore economic sovereignty and decision-making to France. We would protect strategic industries, and we would protect vital areas such as the energy sector. But we would not cut ourselves from the world. There could still be trade.

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

Ninety-nine percent of everyday things are things we don't need - that goes for regular visits to the hairdresser just as it does for clothing. What would it mean if we all consumed 20 percent less? It would be catastrophic. It would mean 20 percent less jobs, 20 percent less taxes, 20 percent less money for schools, doctors, roads. The global economy would collapse.

To protect people's lives and keep our children safe, we must implement public-works spending and do so proudly. If possible, I'd like to see the Bank of Japan purchase all of the construction bonds that we need to issue to cover the cost. That would also forcefully circulate money in the market. That would be positive for the economy, too.

Men in America were terrified that if women got an equal say in society, the system would collapse and their lives would be valued less. Whites in America were scared that if blacks obtained their freedom and equality, the system would collapse and their lives would be devalued. Heterosexuals are terrified that the psychotic institution of marriage will collapse if gays are given their right to marry. And humans are terrified that if animals are liberated and no longer viewed as inferior subordinates, human life will be valued less.

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Today you can buy the Dialogues of Plato for less than you would spend on a fifth of whiskey, or Gibbon's Decline and Fall of the Roman Empire for the price of a cheap shirt. You can buy a fair beginning of an education in any bookstore with a good stock of paperback books for less than you would spend on a week's supply of gasoline.