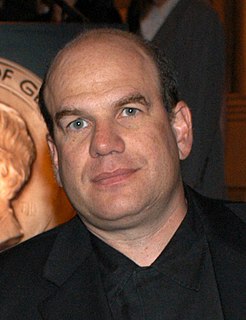

A Quote by Ben Bernanke

Over the years, the U.S. economy has shown a remarkable ability to absorb shocks of all kinds, to recover, and to continue to grow. Flexible and efficient markets for labor and capital, an entrepreneurial tradition, and a general willingness to tolerate and even embrace technological and economic change all contribute to this resiliency.

Quote Topics

Ability

Absorb

All Kinds

Capital

Change

Continue

Contribute

Economic

Economic Change

Economy

Efficient

Efficient Markets

Embrace

Entrepreneurial

Even

Flexible

General

Grow

Kinds

Labor

Labor And Capital

Markets

Over

Recover

Remarkable

Resiliency

Shown

Technological

Tolerate

Tradition

Willingness

Years

Related Quotes

What about precarious labor? It's actually not the most efficient form of labor at all. They were much more efficient when they had loyalty to their workers and people were allowed to be creative and contribute - you know that what precarious labor does is that it's the best weapon ever made to depoliticize labor. They're always putting the political in front of the economic.

I'd love if people relearned the lessons of the 20th century all over again. Which is to say this country progressed economically and socially when we had a better balance between capital and labor. Neither capital or labor won every argument. The battle between the two created economic tension, and transformed the working class into the middle class, and grew the economy.

The ability to change one's mind is probably a key characteristic of the successful investor. Dogmatic and rigid personalities rarely, if ever, succeed in the markets. The markets are a dynamic process, and sustained investment success requires the ability to modify and even change strategies as markets evolve.

Prospects for growth in the year ahead are solid at the national level, and of course, this can only be good news for the Bay Area and California as well. The U. S. economy has shown remarkable resilience in the face of some severe shocks - in particular, the surge in energy prices that began a couple of years ago and the devastation wrought by the twin hurricanes last summer.

For a long time, early industrializing countries were absorptive. They were endlessly able to absorb new labor inputs to keep expanding. This was both an economics and a worldview. Here in the United States, we have the Statue of Liberty sitting in the harbor in New York, which says in huge letters, We stand for absorptive capital. A poetic version: "Give me your tired, your poor, your huddled masses." But what it means is, Come here, we'll absorb you. We absorb these inputs and add them to our growing economy, and we manage this with liberal democracy.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.