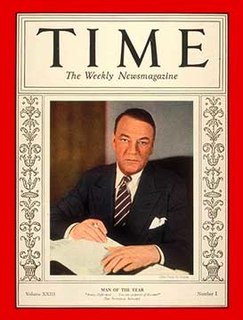

A Quote by Ben Bernanke

The Federal Reserve is not currently forecasting a recession.

Quote Topics

Related Quotes

The reason inflation was brought down to manageable levels, by the time of Ronald Reagan's re-election, was directly attributable to Jimmy Carter's very courageous act, hiring a Federal Reserve chair, with the charge to induce a recession. That recession was probably the reason he didn't win a second term.

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

If the Federal Reserve pursues a policy which Congress or the President believes not to be in the public interest, there is nothing Congress can do to reverse the policy. Nor is there anything the people can do. Such bastions of unaccountable power are undemocratic. The Federal Reserve System must be reformed, so that it is answerable to the elected representatives of the people.