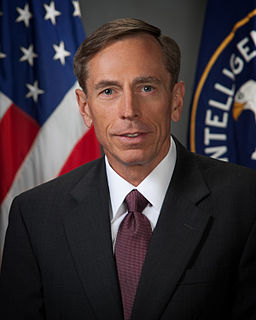

A Quote by Ben Bernanke

House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.

Related Quotes

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.

A price drop in a good stock is only a tragedy if you sell at that price and never buy more. To me, a price drop is an opportunity to load up on bargains from among your worst performers and your laggards that show promise. If you can't convince yourself "When I'm down 25 percent, I'm a buyer" and banish forever the fatal thought "When I'm down 25 percent, I'm a seller," then you'll never make a decent profit in stocks.

There is some evidence that average wave heights are slowly rising, and that freak waves of eighty or ninety feet are becoming more common. Wave heights off the coast of England have risen an average of 25 percent over the past couple of decades, which converts to a twenty-foot increase in the highest waves over the next half century. One cause may be the tightening of environmental laws, which has reduced the amount of oil flushed into the oceans by oil tankers.

The largest 100 corporations hold 25 percent of the worldwide productive assets, which in turn control 75 percent of international trade and 98 percent of all foreign direct investment.The multinational corporation...puts the economic decision beyond the effective reach of the political process and its decision-makers, national governments.

Government is taking 40 percent of the GDP. And that's at the state, local and federal level. President Obama has taken government spending at the federal level from 20 percent to 25 percent. Look, at some point, you cease being a free economy, and you become a government economy. And we've got to stop that.