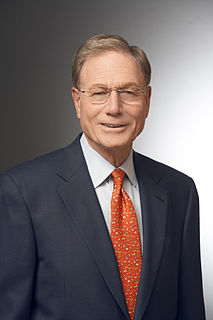

A Quote by Ben Bernanke

Under a cold turkey strategy, at each policy meeting the Federal Open Market Committee would make its best guess about where it ultimately wants the funds rate to be and would move to that rate in a single step.

Related Quotes

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Cold-turkey deficit reduction would cause a significant recession. A recent analysis by the Congressional Budget Office estimated that going headlong over the cliff would cause our gross domestic product, which has been growing at an annual rate of around 2 percent, to fall at a rate of 2.9 percent in the first half of 2013.

The Open Market Committee, as presently established, is plainly not in the public interest. This committee must be operated by purely public servants, representatives of the people as a whole and not any single interest group. The Open Market Committee should be abolished, and its powers transferred to the Federal Reserve Board - the present public members of the committee, with reasonably short terms of office.

The rate of growth of the relevant population is much greater than the rate of growth in funds, though funds have gone up very nicely. But we have been producing students at a rapid rate; they're competing for funds and therefore they're more frustrated. I think there's a certain sense of weariness in the intellectual realm, it's not in any way peculiar to economics, it's a general proposition.

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.

I would be uncomfortable raising the federal funds rate if readings on wage growth, core consumer prices, and other indicators of underlying inflation pressures were to weaken, if market-based measures of inflation compensation were to fall appreciably further, or if survey-based measures were to begin to decline noticeably.

There are simple things which would make sense. Take, say, weatherization, which would make a big cut in the unemployment rate. That's the kind of work that plenty of people are quick to do, and it would save individual households money, and it would make a significant reduction in the threats of climate change. But something is holding it back: the sociopathic character of market systems.

If a country is an attractive place for foreigners to invest their funds, then that country will have a relatively high exchange rate. If it's an unattractive place, it will have a relatively low exchange rate. Those are the fundamentals that determine the exchange rate in a floating exchange rate system.

Interest-rate swaps are a tool used by big cities, major corporations and sovereign governments to manage their debt, and the scale of their use is almost unimaginably massive. It's about a $379 trillion market, meaning that any manipulation would affect a pile of assets about 100 times the size of the United States federal budget.