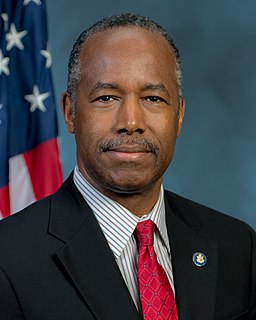

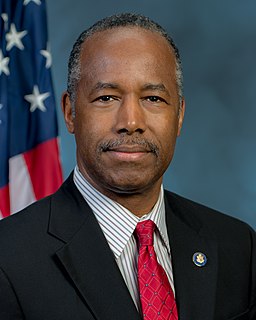

A Quote by Benjamin Carson

Why I've advocated a proportional tax system. You make $10 billion, you pay a billion. You make $10, you pay one. And everybody gets treated the same way. And you get rid of the deductions, you get rid of all the loopholes.

Related Quotes

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

We're going to build a wall and Mexico is going to pay. And the reason they're going to pay and the way they're going to pay, Bob, is this. We have a trade deficit now with Mexico of $58 billion a year. The wall is going to cost $10 billion a year. That's what it's going to cost. It's going to be a powerful wall. It's going to cost $10 billion.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

Yes, we can pay the interest on the debt. We can renew the $500 billion worth of bonds that are coming due. We can mail out our Social Security checks. We can make sure those Medicare claims are honored. We can pay our military. We can protect our veterans. But when you get beyond that, the soup gets a little thin.