A Quote by Benjamin Graham

Most of the time common stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble... to give way to hope, fear and greed.

Related Quotes

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

Just know that it’s fear that keeps most people working at a job. The fear of not paying their bills. The fear of being fired. The fear of not having enough money. the fear of starting over. That’s the price of studying to learn a profession or trade, and then working for money. Most people become a slave to money… and then get angry at their boss.

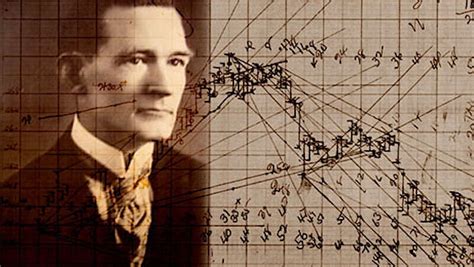

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

I love those historians that are either very simple or most excellent. Such as are between both (which is the most common fashion), it is they that spoil all; they will needs chew our meat for us and take upon them a law to judge, and by consequence to square and incline the story according to their fantasy.