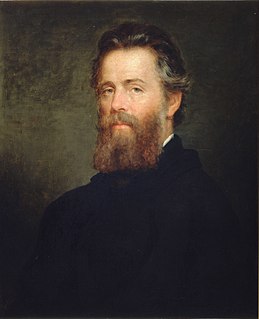

A Quote by Benjamin Graham

Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal.

Related Quotes

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

There aren't any syringes." Red Sox came over and held a sterile pack out. When she tried to take it from him, he kept a grip on the thing. "I know you'll use this wisely." "Wisely?" She snapped the syringe out of his hand. "No, I'm going to poke him in the eye with it. Because that's what they trained me to do in medical school.

We are convinced that the intelligent investor can derive satisfactory results from pricing of either type (market timing or fundamental analysis via price). We are equally sure that if he places his emphasis on timing, in the sense of forecasting, he will end up as a speculator and with a speculator's financial results." And "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.

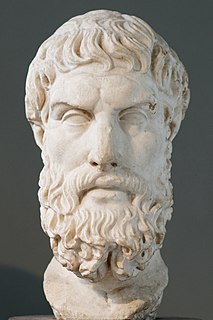

It is impossible to live a pleasant life without living wisely and honorably and justly, and it is impossible to live wisely and honorably and justly without living pleasantly. Whenever any one of these is lacking, when, for instance, the man is not able to live wisely, though he lives honorably and justly, it is impossible for him to live a pleasant life.

A price decline is of no real importance to the bona fide investor unless it is either very substantial say, more than a third from cost or unless it reflects a known deterioration of consequence in the company's position. In a well-defined bear market many sound common stocks sell temporarily at extraordinary low prices. It is possible that the investor may then have a paper loss of fully 50 per cent on some of his holdings, without any convincing indication that the underlying values have been permanently affected.

A price drop in a good stock is only a tragedy if you sell at that price and never buy more. To me, a price drop is an opportunity to load up on bargains from among your worst performers and your laggards that show promise. If you can't convince yourself "When I'm down 25 percent, I'm a buyer" and banish forever the fatal thought "When I'm down 25 percent, I'm a seller," then you'll never make a decent profit in stocks.