A Quote by Benjamin Graham

By refusing to pay too much for an investment, you minimize the chances that your wealth will ever disappear or suddenly be destroyed.

Related Quotes

It is not much different from a person who goes to the gym to exercise on a regular basis versus someone who sits on the couch watching television. Proper physical exercise increases your chances of health, and proper mental exercise increases your chances for wealth. Laziness decreases both health and wealth.

If you have good wealth mentality.... you will generate wealth wherever you go. Even if you lose money temporarily, your wealth mentality will attract it again. If you have a lack mentality, no matter how much you receive or what financial opportunities come your way, wealth will evade you or, if it comes, it won't last.

It's unwise to pay too much, but it's worse to pay too little. When you pay too much, you lose a little money - that's all. When you pay too little, you sometimes lose everything, because the thing you bought was incapable of doing the thing it was bought to do. The common law of business balance prohibits paying a little and getting a lot - it can't be done. If you deal with the lowest bidder, it is well to add something for the risk you run, and if you do that you will have enough to pay for something better.

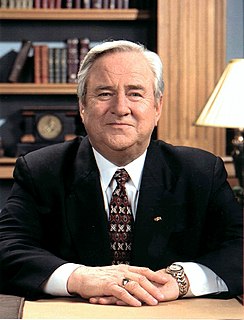

As we faithfully pay our tithes, the Lord will indeed open the windows of heaven and pour us out a blessing, that there shall not be room enough to receive it. I want each of you to know, and especially my children and grandchildren, that I know, as my grandfather did, that if you always pay an honest tithing, the Lord will bless you. It will be the best investment you will ever make.

There's a price you pay for drinking too much, for eating too much sugar, smoking too much marijuana, using too much cocaine, or even drinking too much water. All those things can mess you up, especially, drinking too much L.A. water ... or Love Canal for that matter. But, if people had a better idea of what moderation is really all about, then some of these problems would ... If you use too much of something, your body's just gonna go the "Huh? ... Duh!"

After all, your chances of winning a lottery and of affecting an election are pretty similar. From a financial perspective, playing the lottery is a bad investment. But it's fun and relatively cheap: for the price of a ticket, you buy the right to fantasize how you'd spend the winnings - much as you get to fantasize that your vote will have some impact on policy.

I am saying that out of a spirit of appreciation and gratitude, and a sense of duty, you ought to make whatever adjustment is necessary to give a little of your time-as little as two years-consecrating your strength, your means, your talents to the work of sharing with others the gospel, which is the source of so much of the good that you have. I promise that if you will do so, you will come to know that what appears today to be a sacrifice will prove instead to be the greatest investment that you will ever make.

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.

You'll be riding along in an automobile. You'll be the driver perhaps. You're a Christian. There'll be several people in the automobile with you, maybe someone who is not a Christian. When the trumpet sounds you and the other born-again believers in that automobile will be instantly caught away - you will disappear, leaving behind only your clothes and physical things that cannot inherit eternal life. That unsaved person or persons in the automobile will suddenly be startled to find the car suddenly somewhere crashes.

There are two goddesses in your heart,” he told them. “The Goddess of Wisdom and the Goddess of Wealth. Everyone thinks they need to get wealth first, and wisdom will come. So they concern themselves with chasing money. But they have it backwards. You have to give your heart to the Goddess of Wisdom, give her all your love and attention, and the Goddess of Wealth will become jealous, and follow you.” Ask nothing from your running, in other words, and you’ll get more than you ever imagined.