A Quote by Benjamin Graham

Losing some money is an inevitable part of investing, and there's nothing you can do to prevent it. But to be an intelligent investor, you must take responsibility for ensuring that you never lose most or all of your money.

Related Quotes

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

Of all the wonderful things government says, that's always been just about my favorite. As opposed to if you get to keep the money. Because what you'll do is go out and bury it in your yard, anything to prevent that money from creating jobs. They never stop saying it.We will say, "This is expected to create x number of jobs." On the other hand, we never say that the money we removed from another part of the economy will kill some jobs.

We are seeing a lot of cases where the startups are writing the term sheet, dictating the terms, selling common stock instead of preferred stock, where they don't give the investor veto rights or board seat or privileges, and they are really asking the investor -- why should I take your money when there is other money available.

Most people never feel secure because they are always worried that they will lose their job, lose the money they already have, lose their spouse, lose their health, and so on. The only true security in life comes from knowing that every single day you are improving yourself in some way, that you are increasing the caliber of who you are and that you are valuable to your company, your friends, and your family.

To walk in money through the night crowd, protected by money, lulled by money, dulled by money, the crowd itself a money, the breath money, no least single object anywhere that is not money. Money, money everywhere and still not enough! And then no money, or a little money, or less money, or more money but money always money. and if you have money, or you don't have money, it is the money that counts, and money makes money, but what makes money make money?

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.

When the institutions of money rule the world, it is perhaps inevitable that the interests of money will take precedence over the interests of people. What we are experiencing might best be described as a case of money colonizing life. To accept this absurd distortion of human institutions and purpose should be considered nothing less than an act of collective, suicidal insanity.

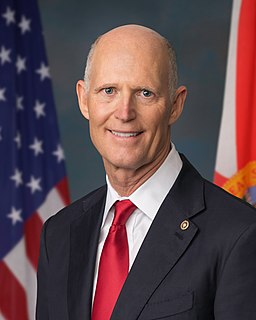

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

I think the bigger the movie is, the harder it is to maintain the idea of an auteur. You're servicing something beyond just your own vision. Whenever there's a lot of money on the line, it is your responsibility to make sure that you're doing your best to have people not lose their money and to actually win by betting on it.