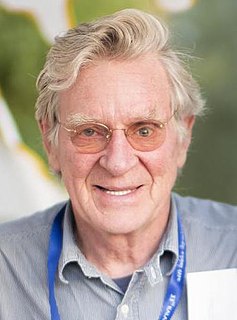

A Quote by Benjamin Graham

Speculators often prosper through ignorance; it is a cliché that in a roaring bull market knowledge is superfluous and experience is a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss

Related Quotes

Just remember, without discipline, a clear strategy, and a concise plan, the speculator will fall into all the emotional pitfalls of the market - jump from one stock to another, hold a losing position too long, and cut out of a winner too soon, for no reason other than fear of losing profit. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator. Then, after a few failures and catastrophes the speculator may become demoralised, depressed, despondent, and abandon the market and the chance to make a fortune from what the market has to offer.

A lot of people, after seeking a bit, have some experience, and sometimes will believe they're enlightened. One has to be careful about that. Especially Americans, who are very external stimulus oriented. When they have some type of deep inner experience, often they think that was the ultimate experience.

We have heard of a Society for the Diffusion of Useful Knowledge. It is said that knowledge is power, and the like. Methinks there is equal need of a Society for the Diffusion of Useful Ignorance, what we will call Beautiful Knowledge, a knowledge useful in a higher sense: for what is most of our boasted so-called knowledge but a conceit that we know something, which robs us of the advantage of our actual ignorance? What we call knowledge is often our positive ignorance; ignorance our negative knowledge.

My experience is that journalists report on the nearest-cliche algorithm, which is extremely uninformative because there aren't many cliches, the truth is often quite distant from any cliche, and the only thing you can infer about the actual event was that this was the closest cliche. It is simply not possible to appreciate the sheer awfulness of mainstream media reporting until someone has actually reported on you. It is so much worse than you think.

Every time you have a big blast-out experience you think that's the ultimate-everything, and of course it isn't, although you can get hints. The key however, is not to take those hint experiences to be the ultimate experience. There always needs to be a balance. For example, when you find something, by having some experience, you always want to keep looking because there could be more to it.

To know God and to find one's full satisfaction in that knowledge is the ultimate goal of Christian experience. The Lord's greatest delight comes when His people discover the ultimate value lies in the knowledge of God. Nothing in the material world can complete with the delights that are present in His Person.

To live means to experience-through doing, feeling, thinking. Experience takes place in time, so time is the ultimate scarce resource we have. Over the years, the content of experience will determine the quality of life. Therefore one of the most essential decisions any of us can make is about how one's time is allocated or invested.

We are convinced that the intelligent investor can derive satisfactory results from pricing of either type (market timing or fundamental analysis via price). We are equally sure that if he places his emphasis on timing, in the sense of forecasting, he will end up as a speculator and with a speculator's financial results." And "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.