A Quote by Benjamin Graham

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Quote Topics

Acquiring

Attitude

Because

Between

Buy

Buying

Certainly

Create

Distinction

Found

High

High Price

Him

Holding

Important

Interest

Investor

Levels

Lies

Low

Market

Most

Movements

Practical

Price

Prices

Primary

Realistic

Refrain

Securities

Sell

Sense

Should

Stock

Suitable

Toward

Which

Wise

Would

Would Be

Related Quotes

We are convinced that the intelligent investor can derive satisfactory results from pricing of either type (market timing or fundamental analysis via price). We are equally sure that if he places his emphasis on timing, in the sense of forecasting, he will end up as a speculator and with a speculator's financial results." And "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

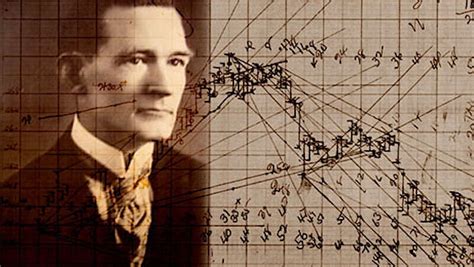

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.

The reader can test his own psychology by asking himself whether he would consider, in retrospect, the selling at 156 in 1925 and buying back at 109 in 1931 was a satisfactory operation. Some may think that an intelligent investor should have been able to sell out much closer to the high of 381 and to buy back nearer the low of 41. If that is your own view you are probably a speculator at heart and will have trouble keeping to true investment precepts while the market rushes up and down.

Near the top of the market, investors are extraordinarily optimistic because they've seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king, speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated. A small rise in interest rates can easily be the catalyst for triggering a bear market at that point.

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Just remember, without discipline, a clear strategy, and a concise plan, the speculator will fall into all the emotional pitfalls of the market - jump from one stock to another, hold a losing position too long, and cut out of a winner too soon, for no reason other than fear of losing profit. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator. Then, after a few failures and catastrophes the speculator may become demoralised, depressed, despondent, and abandon the market and the chance to make a fortune from what the market has to offer.

The individual investor should act consistently as an investor and not as a speculator. This means ... that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money's worth for his purchase.

The investor is neither smart not richer when he buys in an advancing market and the market continues to rise. That is true even when he cashes in a goodly profit, unless either (a) he is definitely through with buying stocks an unlikely story or (b) he is determined to reinvest only at considerably lower levels. In a continuous program no market profit is fully realized until the later reinvestment has actually taken place, and the true measure of the trading profit is the difference between the previous selling level and the new buying level.