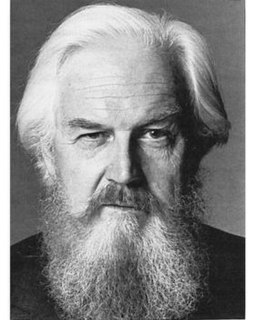

A Quote by Benjamin Graham

All the real money in investment will have to be made as most of it has been in the past not out of buying and selling but out of owning and holding securities, receiving interests and dividends therein, and benefiting from their long-term increases in value. Hence stockholder's major energies and wisdom as investors should be directed toward assuring themselves of the best operating results from their corporations. This in turn means assuring themselves of fully honest and competent managements.

Quote Topics

Assuring

Been

Best

Buying

Buying And Selling

Competent

Corporations

Directed

Dividends

Energies

Fully

Hence

Holding

Honest

In The Past

Increases

Interests

Investment

Investors

Long

Long-Term

Made

Major

Means

Money

Most

Operating

Out

Owning

Past

Real

Receiving

Results

Securities

Selling

Should

Term

Themselves

Toward

Turn

Turn Me

Value

Will

Wisdom

Related Quotes

As I have mentioned before, we cannot make the same sort of money out of permanent ownership of controlled businesses that can be made from buying and reselling such businesses, or from skilled investment in marketable securities. Nevertheless, they offer a pleasant long term form of activity (when conducted in conjunction with high grade, able people) at satisfactory rates of return.

Scientists themselves readily admit that they do not fully understand the consequences of our many-faceted assault upon the interwoven fabric of atmosphere, water, land and life in all its biological diversity. But things could also turn out to be worse than the current scientific best guess. In military affairs, policy has long been based on the dictum that we should be prepared for the worst case. Why should it be so different when the security is that of the planet and our long-term future?

Investors should pay attention not only to whether but also to why current holdings are undervalued. It is critical to know why you have made an investment and to sell when the reason for owning it no longer applies. Look for investments with catalysts that may assist directly in the realization of underlying value. Give reference to companies having good managements with a personal financial stake in the business. Finally, diversify your holdings and hedge when it is financially attractive to do so.

Workers must root out the idea that by keeping the results of their labors to themselves a fortune will be assured to them. Patent fees are so much wasted money. The flying machine of the future will not be born fully fledged and capable of a flight for 1,000 miles or so. Like everything else it must be evolved gradually. The first difficulty is to get a thing that will fly at all. When this is made, a full description should be published as an aid to others. Excellence of design and workmanship will always defy competition.

We make too much out of past performance, and it's very misleading to investors. It causes them to move money around. They buy a fund that's hot and then it turns cold as all hot funds eventually do. And then they get out. Well, buying at the high and selling at the low isn't going to leave you a satisfied shareholder, right?