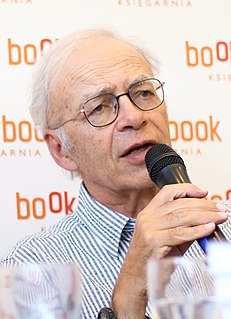

A Quote by Benjamin Graham

A defensive investor can always prosper by looking patiently and calmly through the wreckage of a bear market.

Related Quotes

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

Rip Van Winkle would be the ideal stock market investor: Rip could invest in the market before his nap and when he woke up 20 years later, he'd be happy. He would have been asleep through all the ups and downs in between. But few investors resemble Mr. Van Winkle. The more often an investor counts his money - or looks at the value of his mutual funds in the newspaper - the lower his risk tolerance.

The hardest thing over the years has been having the courage to go against the dominant wisdom of the time to have a view that is at variance with the present consensus and bet that view. The hard part is that the investor must measure himself not by his own perceptions of his performance, but by the objective measure of the market. The market has its own reality. In an immediate emotional sense the market is always right so if you take a variant point of view you will always be bombarded for some time by conventional wisdom as expressed by the market.

A price decline is of no real importance to the bona fide investor unless it is either very substantial say, more than a third from cost or unless it reflects a known deterioration of consequence in the company's position. In a well-defined bear market many sound common stocks sell temporarily at extraordinary low prices. It is possible that the investor may then have a paper loss of fully 50 per cent on some of his holdings, without any convincing indication that the underlying values have been permanently affected.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

we have complaints that institutional dominance of the stock market has put 'the small investor at a disadvantage because he can't compete with the trust companies' huge resources, etc. The facts are quite the opposite. It may be that the institutions are better equipped than the individual to speculate in the market.But I am convinced that an individual investor with sound principles, and soundly advised, can do distinctly better over the long pull than large institutions.