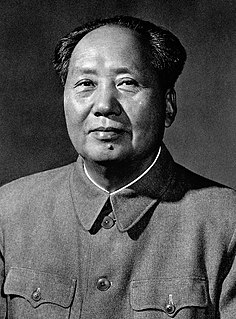

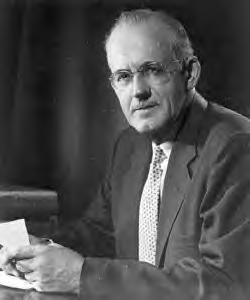

A Quote by Benjamin Graham

The chief losses to investors come from the purchase of low-quality securities at times of favorable business conditions.

Related Quotes

At certain times in the revolutionary struggle, the difficulties outweigh the favorable conditions and so constitute the principal aspect of the contradiction and the favorable conditions constitute the secondary aspect. But through their efforts the revolutionaries can overcome the difficulties step by step and open up a favorable new situation, thus a difficult situation yields place to a favorable one.

Resentment is at work when one so hates somebody for his more favorable circumstances that one is prepared to bear heavy losses if only the hated one might also come to harm. Many of those who attack capitalism know very well that their situation under any other economic system will be less favorable.

However, if one has been playing the buy-and-hold game with quality securities, one has been exposed to a substantial amount of market risk because the valuations placed on these securities have implied overly rosy scenarios prone to popular revision in times of more realistic expectation. This is one of those times, but it is my feeling that the revisions have not been severe enough, the expectations not yet realistic enough. Hence, the world's best companies largely remain overpriced in the marketplace.

Churches are more prosperous than at any time within the past several hundred years. But the alarming thing is that our gains are mostly external and our losses wholly internal; and since it is the quality of our religion that is affected by internal conditions, it may be that our supposed gains are but losses spread over a wider field.

One other specific piece of guidance we've offered is that low-quality content on some parts of a website can impact the whole site’s rankings, and thus removing low quality pages, merging or improving the content of individual shallow pages into more useful pages, or moving low quality pages to a different domain could eventually help the rankings of your higher-quality content.

The successful entrepreneurs on the free market will be the ones most adept at anticipating future business conditions. Yet, the forecasting can never be perfect, and entrepreneurs will continue to differ in the success of their judgments. If this were not so, no profits or losses would ever be made in business.

I still believe that for good business analysts a concentrated portfolio is a good strategy combined with a long term horizon. Once again, the secret to success in following the formula strategy is patience, a quality in short supply for both professionals and individual investors alike. I think investors should have a large portion of their assets in equities over time.

If we're talking about buying exchanges abroad, we have to have global securities standards, as we have global banking regulations. I'm talking about margins. Now, the United States has certain margin requirements that are not the same in London. Investors and hedge funds that want to borrow more money against securities ? if they can't in the U.S., they go abroad. That could add additional risks to the global economy.

I didn't want to be criticized for taking low-quality photographs, so I tried to reach the best, highest quality of photography and then to combine this with a conceptual art practice. But thinking back, that was the wrong decision [laughs]. Developing a low-quality aesthetic is a sign of serious fine art-I still see this.