A Quote by Benjamin Graham

The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored.

Related Quotes

If you expect to be a net saver during the next 5 years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

The historian should be fearless and incorruptible; a man of independence, loving frankness and truth; one who, as the poets says, calls a fig a fig and a spade a spade. He should yield to neither hatred nor affection, not should be unsparing and unpitying. He should be neither shy nor deprecating, but an impartial judge, giving each side all it deserves but no more. He should know in his writing no country and no city; he should bow to no authority and acknowledge no king. He should never consider what this or that man will think, but should state the facts as they really occurred.

I feel no shame at being found still owning a share when the bottom of the market comes…I would go much further than that. I should say that it is from time to time the duty of a serious investor to accept the depreciation of his holdings with equanimity and without reproaching himself. … An investor…should be aiming primarily at long-period results, and should be solely judged by these.

A price decline is of no real importance to the bona fide investor unless it is either very substantial say, more than a third from cost or unless it reflects a known deterioration of consequence in the company's position. In a well-defined bear market many sound common stocks sell temporarily at extraordinary low prices. It is possible that the investor may then have a paper loss of fully 50 per cent on some of his holdings, without any convincing indication that the underlying values have been permanently affected.

The investor is neither smart not richer when he buys in an advancing market and the market continues to rise. That is true even when he cashes in a goodly profit, unless either (a) he is definitely through with buying stocks an unlikely story or (b) he is determined to reinvest only at considerably lower levels. In a continuous program no market profit is fully realized until the later reinvestment has actually taken place, and the true measure of the trading profit is the difference between the previous selling level and the new buying level.

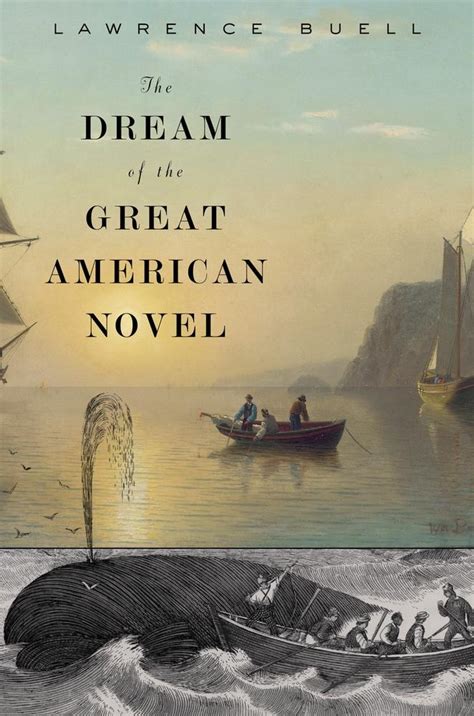

Writing is a vocation and, as in any other calling, a writer should develop his talents for the greater glory of God. Novels should be neither homilies nor apologetics: the author's faith, and the grace he has received, will become apparent in his work even if it does not have Catholic characters or a Catholic theme.