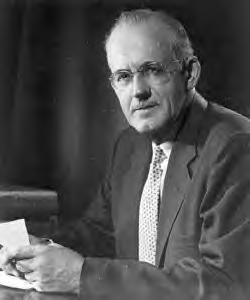

A Quote by Benjamin Graham

Observation over many years has taught us that the chief losses to investors come from the purchase of low-quality securities at times of good business conditions. The purchasers view the good current earnings as equivalent to 'earning power' and assume that prosperity is equivalent to safety.

Related Quotes

In our view, though, investment students need only two well-taught courses-How to Value a Business, and How to Think about Market Prices. Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business who's earnings are virtually certain to be materially higher five, ten and twenty years from now.

I still believe that for good business analysts a concentrated portfolio is a good strategy combined with a long term horizon. Once again, the secret to success in following the formula strategy is patience, a quality in short supply for both professionals and individual investors alike. I think investors should have a large portion of their assets in equities over time.

We wish to control big business so as to secure among other things good wages for the wage-workers and reasonable prices for the consumers. Wherever in any business the prosperity of the business man is obtained by lowering the wages of his workmen and charging an excessive price to the consumers we wish to interfere and stop such practices. We will not submit to that kind of prosperity any more than we will submit to prosperity obtained by swindling investors or getting unfair advantages over business rivals.

The big picture is: the main thing you should be concerned about in the future are incremental returns on capital going forward. As it turns out, past history of a good return on capital is a good proxy for this but obviously not foolproof. I think this is an area where thoughtful analysis can add value to any simple ranking/screening strategy such as the magic formula. When doing in depth analysis of companies, I care very much about long term earnings power, not necessarily so much about the volatility of that earnings power but about my certainty of "normal" earnings power over time.

Churches are more prosperous than at any time within the past several hundred years. But the alarming thing is that our gains are mostly external and our losses wholly internal; and since it is the quality of our religion that is affected by internal conditions, it may be that our supposed gains are but losses spread over a wider field.