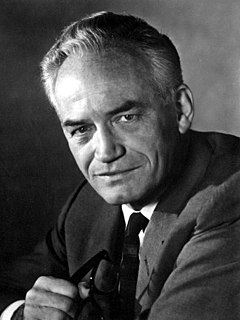

A Quote by Benjamin Graham

Diversification is an established tenet of conservative investment.

Quote Topics

Related Quotes

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

It is our argument that a sufficiently low price can turn a security of mediocre quality into a sound investment opportunity - provided that the buyer is informed and experienced and he practices adequate diversification. For, if the price is low enough to create a substantial margin of safety, the security thereby meets our criterion of investment.

The conservatives have already accepted a large part of the collectivist creed-a creed that has governed policy for so long that many of its institutions have come to be accepted as a matter of course and have become a source of pride to "conservative" parties who created them. Here the believer in freedom cannot but conflict with the conservative and take an essentially radical position, directed against popular prejudices, entrenched positions, and firmly established privileges. Follies and abuses are no better for having long been established principles of folly.

It's important to Russia to be able to attract capital and to attract technology to develop their oil fields, their oil and gas fields, many of which suffer from lack of access to the very best technologies. And it's also important, and this has been the US government's view to have diversification of supply, diversification of supply roots and, of course, diversification in terms of alternative energy.

The Berkshire-style investors tend to be less diversified than other people. The academics have done a terrible disservice to intelligent investors by glorifying the idea of diversification. Because I just think the whole concept is literally almost insane. It emphasizes feeling good about not having your investment results depart very much from average investment results. But why would you get on the bandwagon like that if somebody didn't make you with a whip and a gun?

Diversification is something that stock brokers came up with to protect themselves, so they wouldn't get sued for making bad investment choices for clients. Henry Ford never diversified, Bill Gates didn't diversify. The way to get rich is to put your eggs in one basket, but watch that basket very carefully. And make sure you have the right basket.