A Quote by Benjamin Graham

For 99 issues out of 100 we could say that at some price they are cheap enough to buy and at some price they would be so dear that they would be sold.

Related Quotes

Edge also implies what Ben Graham....called a margin of safety. You have a margin of safety when you buy an asset at a price that is substantially less than its value. As Graham noted, the margin of safety 'is available for absorbing the effect of miscalculations or worse than average luck.' ...Graham expands, "The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

I have one other issue I'd like to throw on the table. I hesitate to do it, but let me tell you some of the issues that are involved here. If we are dealing with psychology, then the thermometers one uses to measure it have an effect. I was raising the question on the side with Governor Mullins of what would happen if the Treasury sold a little gold in this market. There's an interesting question here because if the gold price broke in that context, the thermometer would not be just a measuring tool. It would basically affect the underlying psychology.

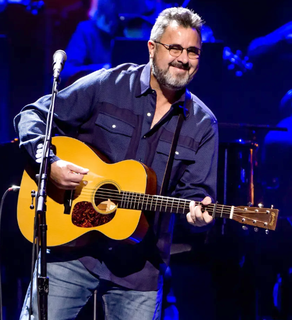

The devaluation of music and what it's now deemed to be worth is laughable to me. My single costs 99 cents. That's what a single cost in 1960. On my phone, I can get an app for 99 cents that makes fart noises - the same price as the thing I create and speak to the world with. Some would say the fart app is more important. It's an awkward time. Creative brains are being sorely mistreated.

At first I hoped that such a technically unsound project would collapse but I soon realized it was doomed to success. Almost anything in software can be implemented, sold, and even used given enough determination. There is nothing a mere scientist can say that will stand against the flood of a hundred million dollars. But there is one quality that cannot be purchased in this way - and that is reliability. The price of reliability is the pursuit of the utmost simplicity. It is a price which the very rich find most hard to pay.

Today you can buy the Dialogues of Plato for less than you would spend on a fifth of whiskey, or Gibbon's Decline and Fall of the Roman Empire for the price of a cheap shirt. You can buy a fair beginning of an education in any bookstore with a good stock of paperback books for less than you would spend on a week's supply of gasoline.

If I owned any of these Hot New Issues that have doubled, tripled, quintupled or umptupled within days and in some cases hours after they were issued, I most certainly would grab my fabulous windfall, thank my lucky stars and invest the money. It's utter nonsense to think any newly issued stock is really worth two, ten or 20 times the [offering] price.... A management so stupid as to sell shares [cheap], and an underwriter so obtuse as not to discern the real value, together would provide reason enough for a sensible man to get rid of his shares.

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.