A Quote by Benoit Mandelbrot

Most economists, when modeling market behavior, tend to sweep major fluctuations under the rug and assume they are anomalies. What I have found is that major rises and falls in prices are actually inevitable.

Related Quotes

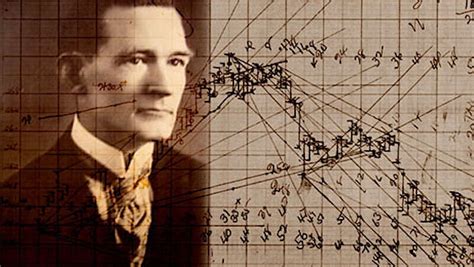

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

I'm even stunned at some of the majors you can get in college these days. Like you can major in the mating habits of the Australian rabbit bat, major in leisure studies... Okay, get a journalism major. Okay, education major, journalism major. Right. Philosophy major, right. Archeology major. I don't know, whatever it is. Major in ballroom dance, of course. It doesn't replace work. How about a major in film studies? How about a major in black studies? How about a major in women studies? How about a major in home ec? Oops, sorry! No such thing.

I like my house to be unique to me. Sure, I've bought plenty of things out of a catalog, but the way I put them together in my home is special. You might have bought your sofa at a major home decorating store, but the rug you found at the flea market is so unique, it takes your room from 'carbon copy' to 'simply yours' in no time.

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

The New Finance focused on the market's major systematic mistake. In failing to appreciate the strength of competitive forces in a market economy, it over estimates the length of the short run. In doing so, it overreacts to records of success and failure for individual companies, driving the prices of successful firms too high and their unsuccessful counterparts too low.