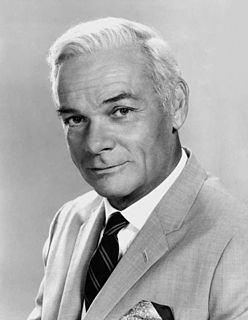

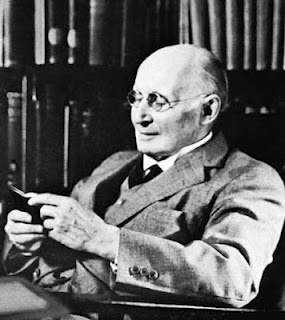

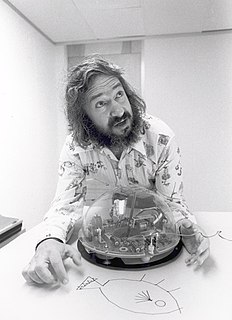

A Quote by Benoit Mandelbrot

The techniques I developed for studying turbulence, like weather, also apply to the stock market

Quote Topics

Related Quotes

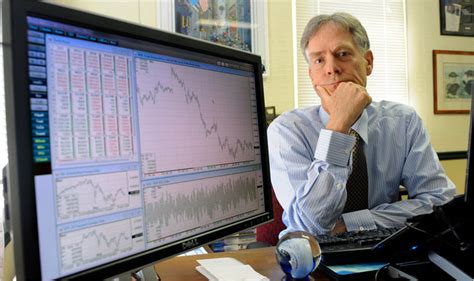

In college I started studying the stock market. I went down to the stock exchange, watched all the activity from the visitors' gallery, people running around, calling numbers, shouting, and all the paper flying and the bells ringing, and of course that was exciting, and it seemed to lend itself to my analytical skills.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market's history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. Arithmetic scale is quite acceptable for tracking hourly waves. Channeling techniques work acceptably well on arithmetic scale with shorter term moves.