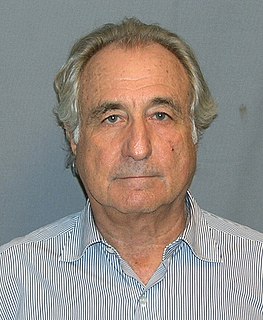

A Quote by Bernard Madoff

The person that is buying a share of stock is convinced he knows something that the other person who's selling it to him does not know. There's no zero sum game in Wall Street.

Related Quotes

Nowhere does history indulge in repetitions so often or so uniformly as in Wall Street. When you read contemporary accounts of booms or panics, the one thing that strikes you most forcibly is how little either stock speculation or stock speculators today differ from yesterday. The game does not change and neither does human nature.

On the basis of the eternal will of God we have to think of EVERY HUMAN BEING, even the oddest, most villainous or miserable, as one to whom Jesus Christ is Brother and God is Father; and we have to deal with him on this assumption. If the other person knows that already, then we have to strengthen him in the knowledge. If he does no know it yet or no longer knows it, our business is to transmit this knowledge to him.

Liberation does not concern the person, for liberation is freedom from the person. Basically the disciple and teacher are identical. Both are the timeless axis of all action and preception. The only difference is that one 'knows' himself for what he is while the other does not. The idea of being a person, an ego, is nothing other than an image held together by memory.

I have no objection to any person's religion, be it what it may, so long as that person does not kill or insult any other person, because that other person don't believe it also. But when a man's religion becomes really frantic; when it is a positive torment to him; and, in fine, makes this earth of ours an uncomfortable inn to lodge in; then I think it high time to take that individual aside and argue the point with him.

One problem with politics is that it is a zero sum game, i.e. politicians argue how to cut the pie smaller and smaller, by reshuffling pieces of the pie. I think this is destructive. Instead, we should be creating a bigger pie, i.e. funding the science that is the source of all our prosperity. Science is not a zero sum game.

In Newark, we see a problem and want to seize it, but we run up against the wall of state government, the wall of federal government that does not have the flexibility or doesn't see problems, even. At the federal level, it's often a zero-sum game: If you win, I lose. At the local level, it's just not local that. It's win-win-win.

It's one thing to be dumb or ignorant or be in over your head. But if you can be the person who knows how much he does not know and be curious about the things you do not know, then that automatically lends itself to being a big-hearted, welcoming person who wants to know about every single person you meet.