A Quote by Bernie Sanders

Establishing a 0.03 percent Wall Street speculation fee, similar to what we had from 1914-1966, would dampen the dangerous level of speculation and gambling on Wall Street, encourage the financial sector to invest in the productive economy and reduce the deficit by more than $350 billion over 10 years.

Related Quotes

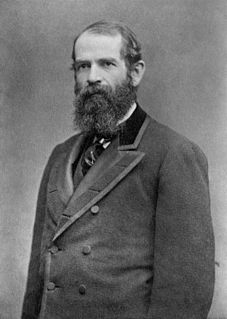

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

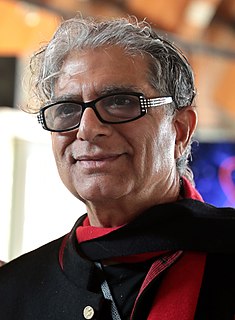

I think the money for the solutions for global poverty is on Wall Street. Wall Street allocates capital. And we need to get capital to the ideas that are successful, whether it's microfinance, whether it's through financial literacy programs, Wall Street can be the engine that makes capital get to the people who need it.

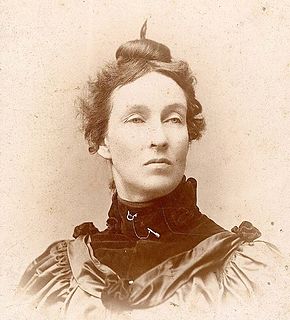

Wall Street owns the country. It is no longer a government of the people, for the people and by the people, but a government for Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master…Let the bloodhounds of money who have dogged us thus far beware.

Look at what's happening between Main Street and Wall Street. The stock market index is up 136 percent from the bottom. Middle class jobs lost during the correction: six million. Middle class jobs recovered: one million. So therefore we're up 16 percent on the jobs that were lost. These are only born-again jobs. We don't really have any new jobs, and there's a massive speculative frenzy going on in Wall Street that is disconnected from the real economy.