A Quote by Bethany McLean

In capital we trust. Capital is our savior, our holy grail, our fountain of youth, or at least health, for banks.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

What we prefer to do is operate our investment bank in a way that is like what investment banks used to be, which is a middle man - someone who is here to match people who need capital with people who have capital - and not position ourselves at the center of that by taking big positions on a trading stance.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

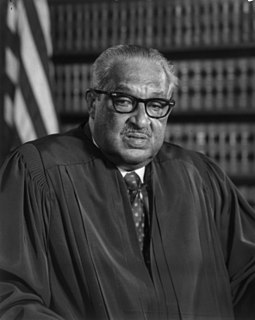

When in Gregg v. Georgia the Supreme Court gave its seal of approval to capital punishment, this endorsement was premised on the promise that capital punishment would be administered with fairness and justice. Instead, the promise has become a cruel and empty mockery. If not remedied, the scandalous state of our present system of capital punishment will cast a pall of shame over our society for years to come. We cannot let it continue.