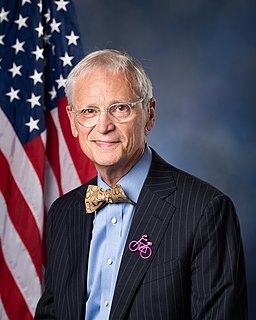

A Quote by Bill Dedman

In more than 500 instances, from the Gulf of Alaska to Bar Harbor, Maine, FEMA has remapped waterfront properties from the highest-risk flood zone, saving the owners as much as 97 percent on the premiums they pay into the financially strained National Flood Insurance Program.

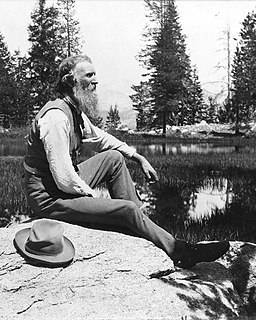

Related Quotes

We are facing a flood tide of factors into our daily lives and the lives of our children that conspire against weight control, and for that matter, health, any single policy or program we use to turn the tide is like a single sandbag. You put down the sandbag on the banks of the river. You could ask the question: Have we held back the flood? A sandbag isn't designed to hold back the flood. A sandbag is designed to be part of a levy to hold back the flood. It doesn't matter if it's a good sandbag, maybe a perfectly good sandbag. By itself it can't fix the problem.