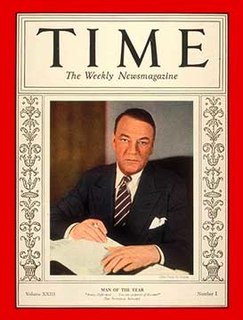

A Quote by Bill Foster

Alan Greenspan is going to go down in history as one of the worst Federal Reserve chairmen ever.

Related Quotes

[Ben Carson] critics say that your inexperience shows. You've suggested that the Baltic States are not a part of NATO, you were unfamiliar with the major political parties and government in Israel, and domestically, you thought Alan Greenspan had been treasury secretary instead of federal reserve chair.

The dirty little secret is that both houses of Congress are irrelevant. ... America's domestic policy is now being run by Alan Greenspan and the Federal Reserve, and America's foreign policy is now being run by the International Monetary Fund [IMF]. ...when the president decides to go to war, he no longer needs a declaration of war from Congress.