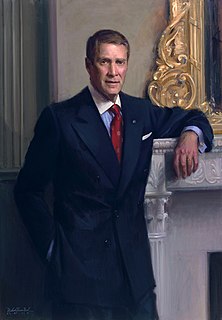

A Quote by Bill Frist

Voluntary personal savings accounts would enable future retirees to harness the power of the marketplace when saving for their retirements.

Related Quotes

At the heart of Erisa is the requirement that plan fiduciaries act with an 'eye single' to funding the retirements of plan participants and beneficiaries. This means investment decisions must be based solely on whether they enhance retirement savings, regardless of the fiduciary's personal preferences.

In a speech at the just-concluded G20 summit in London, President Obama urged Americans not to let their fears crimp their spending. It would be unwise, he argued, for Americans to let the fear of job loss, lack of savings, unpaid bills, credit card debt or student loans deter them from making major purchases. According to the president, 'we must spend now as an investment for the future'....instead of saving for the future, we must spend for the future.

If achieving the Hong Kong dream becomes a vanishing hope, then our society will suffer. What would the Hong Kong dream be? It's no different from the American dream, whereby an everyday man on the street who works hard would be able to make good savings and use those savings as equity for their future small business.