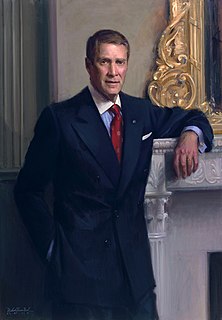

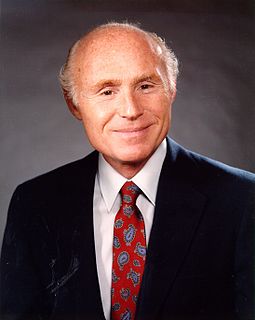

A Quote by Bill Frist

Personal savings accounts to me are one of the most powerful things, not necessarily in saving, solvency, or bankruptcy of the program, but in guaranteeing, the words I used a few minutes ago, a safe and secure retirement for our seniors.