A Quote by Bill Gross

When does money run out of time? The countdown begins when investable assets pose too much risk for too little return; when lenders desert credit markets for other alternatives such as cash or real assets.

Related Quotes

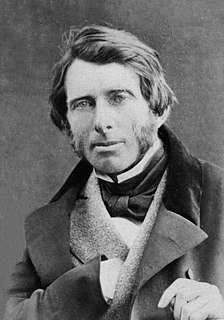

It's unwise to pay too much, but it's worse to pay too little. When you pay too much, you lose a little money - that's all. When you pay too little, you sometimes lose everything, because the thing you bought was incapable of doing the thing it was bought to do. The common law of business balance prohibits paying a little and getting a lot - it can't be done. If you deal with the lowest bidder, it is well to add something for the risk you run, and if you do that you will have enough to pay for something better.

If God was the owner, I was the manager. I needed to adopt a steward's mentality toward the assets He had entrusted - not given - to me. A steward manages assets for the owner's benefit. The steward carries no sense of entitlement to the assets he manages. It's his job to find out what the owner wants done with his assets, then carry out his will.

When you consider the sheer magnitude of investable equities to choose from in the world's emerging markets, you realize that finding one that looks attractive enough to warrant investing your faith and assets in is as formidable a task as finding a needle in a haystack. Fortunately, researching investment opportunities is a lot more interesting than digging for needles in haystacks.

If you want to spend more money in restaurants, use credit cards more than cash. If you want to spend less, use cash more than credit cards. But in general, we can think about how to use the pain of paying and how much of it do we want. And I think we have like a range. Credit cards have very little pain of paying, debit cards have a little bit more because you feel like today, at least it is coming out of your checking account, and cash has much more.

I believe investors should invest for the long run, so I don't buy and sell. I usually maintain the classic index of global equities, diversified U.S. and global and emerging markets, and when the risk is larger, I diminish the amount in global equities and put more into liquid assets - but very irregularly.