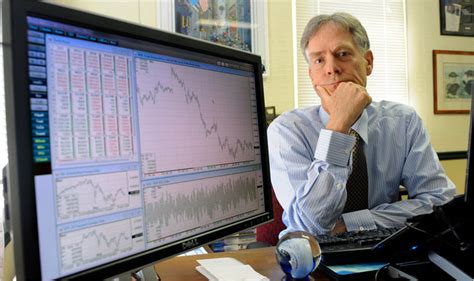

A Quote by Bill Gross

Americans now know that housing prices can go down and they can go down by 10, 20, 30, and in some cases, 40 or 50 percent. We know they can go down. But five years ago, we thought they could only go up.

Related Quotes

Everybody would be better off if they could buy housing for only, let's say, a carrying charge of one-quarter of their income. That used to be the case 50 years ago. Buyers had to save up and make a higher down payment, giving them more equity - perhaps 25 or 30 percent. But today, banks are creating enough credit to bid up housing prices again.

The simple model of a bridge is great, and you could not build a bridge without understanding it well. But if you're actually building the bridge, you need to know the site. A lot of economics is like that: When prices go up, demand is gonna go down. You can't forget that and run your economy. But it's not the only thing you need to know.

The point is, not to resist the flow. You go up when you're supposed to go up and down when you're supposed to go down. When you're supposed to go up, find the highest tower and climb to the top. When you're supposed to go down, find the deepest well and go down to the bottom. When there's no flow, stay still. If you resist the flow, everything dries up. If everything dries up, the world is darkness.

What we've witnessed in the past 25 or 30 years is just incredible. We've birthed 30,000 or 40,000 restaurants. I used to go to Europe every year to get experience [and ideas]. I don't go to Europe anymore. I go to Oregon, I go to Washington, I go to Louisiana, I go to Little Rock, I go to Austin, I travel New York City. I don't go to Europe anymore.

It is as true for individuals as it is for the world itself: everything comes in waves. If you ride the waves of change, you succeed. If you ignore them, you fail. When the wave is down, most people resist it by trying to go up. When the wave goes up, you should go up with it. When it comes down, you go down.

Can't nobody do what Fetty Wap does. So when I go to the studio, it may be four to five hours max, probably three days out the week. I used to go to the studio for 10 to 15 hours, and I would do five to 10 songs. Now I go for four to five hours and I do, like, 15 to 20 songs. I'm an ad lib guy. Most people know me for my ad libs.

Be flexible. Don't be afraid to change your mind. If you're wrong, change your mind. If you go down the wrong path, and you're down 10-12%, it's better to sell down 15% versus 50%. If you have an idea that something is going to happen, you're predicting the future, and it's OK to be wrong. Where you can go wrong is by making a prediction that doesn't come true, and then sticking with it.