A Quote by Bill Moyers

The delusional is no longer marginal.

Quote Topics

Related Quotes

I feel we have to begin standing our ground in the places we love. I think that we have to demand that concern for the land, concern for the Earth, and this extension of community that we've been speaking of, is not marginal - in the same way that women's rights are not marginal, in the same way that rights for children are not marginal. There is no separation between the health of human beings and the health of the land. It is all part of a compassionate view of the world.

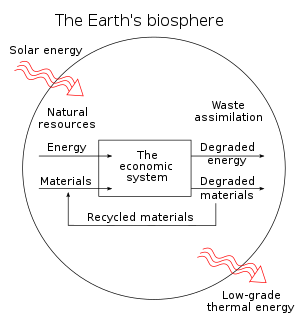

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

Keynesian modelling relies on marginal propensity to consume and marginal propensity to invest. The idea that if we give more money to the poor, they have a propensity to consume that's much higher than the wealthy, though I wish they would talk to my wife about that; she seems to have a propensity to consume.

You have to believe in yourself. But you know what? There's a fine line between believing in yourself and being delusional. And I'm sure there were a lot of people who thought I was being delusional when they saw me attempting to become a big shot in the world of pro wrestling. Luckily, it worked out: it doesn't work out for that many people.

Even if we could grow our way out of the crisis and delay the inevitable and painful reconciliation of virtual and real wealth, there is the question of whether this would be a wise thing to do. Marginal costs of additional growth in rich countries, such as global warming, biodiversity loss and roadways choked with cars, now likely exceed marginal benefits of a little extra consumption. The end result is that promoting further economic growth makes us poorer, not richer.