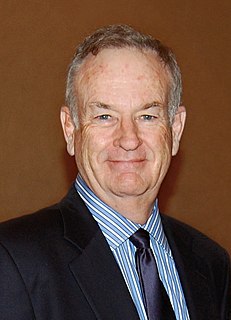

A Quote by Bill O'Reilly

I was an advocate of the deregulation movement and I made - along with a lot of other smart people - a fundamental mistake. The financial industry undergirded the entire economy and if it is made riskier by deregulation and collapses in widespread bankruptcies as what happened in 2008, the entire economy freezes because it runs on credit.

Related Quotes

I was an advocate of the deregulation movement and I made - along with a lot of other smart people - a fundamental mistake, which is that deregulation works fine in industries which do not pervade the economy. The financial industry undergirded the entire economy and if it is made riskier by deregulation and collapses in widespread bankruptcies as what happened in 2008, the entire economy freezes because it runs on credit.

Deregulation is a popular term that's used across the political spectrum. And it's one of these terms like "choice," that corporate interests have used because they know their focus-group buzzword testing makes it sound like a popular word. Because, who can be against deregulation? Being free, having liberty, not having someone tell you what to do, being deregulated, hey, that sounds great. But deregulation is a non sequitur in the realm of media policy or media regulation. The issue is never regulation versus deregulation; our entire system is built on media policies and subsidies.

I think the first thing is to recognize a mistake that Obama made. And others have made in thinking that you can revolutionize a system that's unbelievably complex and interlinked, one-sixth of the economy. That was a mistake because whenever you change one thing, it changes 80 other things, and now if you're changing everything at once, you have no idea what the outcome is going to be and you get all of these unintended side effects.

The entire economy relies on the suspension of disbelief. So does a fairy story or an animated cartoon. This means that no matter how soberly the financial experts dress, no matter how dry their language, the economy they worship can only ever be as plausible as an episode of 'SpongeBob SquarePants.'

Too-easy credit and millions of bad loans made during the U.S. housing bubble paved the way for the financial calamity and Great Recession that followed. Today, by contrast, credit is too tight. Mortgage loans are particularly hard to get, creating a problem for the housing market and the broader economy.