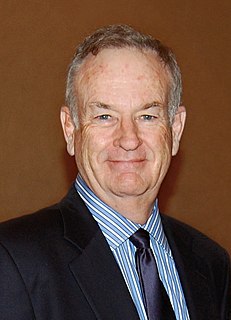

A Quote by Bill O'Reilly

I think I understand the Constitution a little bit because in 1971 we went off the gold standard under President Nixon into the Federal Reserve notes because we were a worldwide currency.

Related Quotes

The tenth amendment said the federal government is supposed to only have powers that were explicitly given in the Constitution. I think the federal government's gone way beyond that. The Constitution never said that you could have a Federal Reserve that would have $2.8 trillion in assets. We've gotten out of control.

America really started to die when the Federal Reserve was founded, and it really started to die in 1971 when the gold backing was taken away from the dollar, and this currency with Ben Bernanke just printing up or counterfeiting as much money as he wants and destroying the economy is really destroying the economy.

Violence is the gold standard, the reserve that guarantees order. In actuality, it is better than a gold standard, because violence has universal value. Violence transcends the quirks of philosophy, religion, technology, and culture. () It's time to quit worrying and learn to love the battle axe. History teaches us that if we don't, someone else will.

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

Notes are tricky in an audition, because I find, more often than not, my instinct is right. If they have a preconceived notion about the role and it goes against my instinct, unless it makes sense to me, it often throws off what I'm trying to do. Though sometimes they have an insight that I don't because they've been living with the script. I don't have one feeling or another about notes, but it is always a little bit of a red alert when I get one in an audition.

Transparency concerning the Federal Reserve's conduct of monetary policy is desirable because better public understanding enhances the effectiveness of policy. More important, however, is that transparent communications reflect the Federal Reserve's commitment to accountability within our democratic system of government.

What's happening is there's transfer of wealth from the poor and the middle class to the wealthy. This comes about because of the monetary system that we have. When you inflate a currency or destroy a currency, the middle class gets wiped out, so the people who get to use the money first, which is created by the Federal Reserve System, benefit, so the money gravitates to the banks and to Wall Street. That's why you have more billionaires than ever before.

It may seem strange, but Congress has never developed a set of goals for guiding Federal Reserve policy. In founding the System, Congress spoke about the country's need for "an elastic currency." Since then, Congress has passed the Full Employment Act, declaring its general intention to promote "maximum employment, production, and purchasing power." But it has never directly counseled the Federal Reserve.