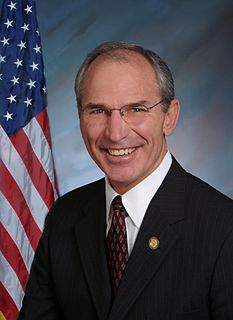

A Quote by Bob Beauprez

The Democrats are obsessing about raising tax rates, while the GOP talks about closing loopholes.

Related Quotes

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

High tax rates in the upper income brackets allow politicians to win votes with class warfare rhetoric, painting their opponents as defenders of the rich. Meanwhile, the same politicians can win donations from the rich by creating tax loopholes that can keep the rich from actually paying those higher tax rates - or perhaps any taxes at all. What is worse than class warfare is phony class warfare. Slippery talk about 'fairness' is at the heart of this fraud by politicians seeking to squander more of the nation's resources.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

When the president talks about tax reform, he talks about the people who will benefit. He talks about American jobs. He talks about the fact that we're going to be taking money that's overseas and bringing it back to the United States so that it will employ American workers. I think that focus again on the American working and middle class is- is-is to me the most thoughtful and, in some ways, the most genius part of Trump's approach to politics.