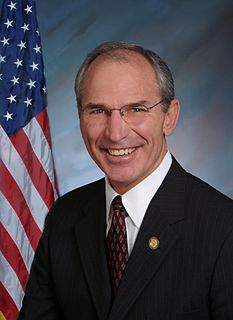

A Quote by Bob Beauprez

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

Related Quotes

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

Growth works. What we're doing in the administration to spur growth in terms of regulatory form work. And what we're working is to make sure that those tax cuts add to that. We do believe that sustained 3 percent economic growth is possible and that that is the way you can balance the budget long-term.

Budget deficits are not caused by wild-eyed spenders, but by slow economic growth and periodic recessions. And any new recession would break all deficit records. In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.