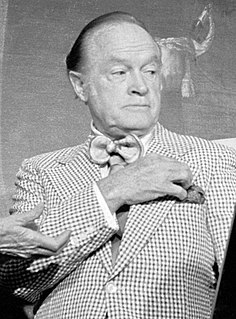

A Quote by Bob Hope

I like to come to Washington, D.C., at least once a year. Why should my tax money travel more than I do?

Related Quotes

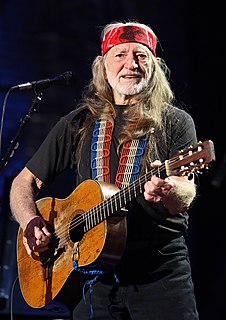

There's a lot of money in selling marijuana. If you can do it legally, that's good. Why should all the criminals make the money? This is what people are thinking. If it's happening, if it's going to be legal, let's tax it and regulate it, like we do with everything else and make some money off this. I think that's one reason why people are talking this a little more seriously.

Why should not every individual man have existed more than once upon this world? Why should I not come back as often as I am capable of acquiring fresh knowledge? Is this hypothesis so laughable merely because it is the oldest? Because the human understanding, before the sophistries of the schools had dissipated and debilitated it, lighted upon it at once?

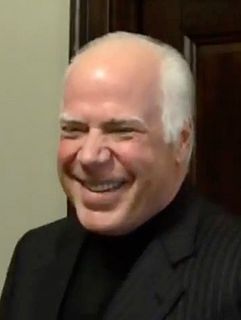

We're talking about should we increase taxes? Why not put a tax on carbon emissions. It would raise a lot of money, it would reduce the environmental damages in the future, it would solve so many problems, and it would be a much more constructive thing to do than to think about raising the income tax.

As for loving woman, I have never understood why some people had a fit. I still don't. It seems fine to me. If an individual is productive responsible, and energetic, why should her choice in a partner make such a fuss? The government is only too happy to take my tax money and yet they uphold legislation that keeps me a second class citizen. Surely, there should be a tax break for those of us who are robbed of full and equal participation and protection in the life of our nation.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.