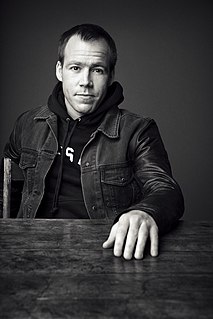

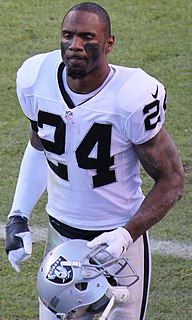

A Quote by Bobby Wagner

A company can be an amazing company, but they can set their valuation of their company so high to where they price themselves out.

Related Quotes

Shareholder activism is not a privilege - it is a right and a responsibility. When we invest in a company, we own part of that company and we are partly responsible for how that company progresses. If we believe there is something going wrong with the company, then we, as shareholders, must become active and vocal.

A company is a multidimensional system capable of growth, expansion, and self-regulation. It is, therefore, not a thing but a set of interacting forces. Any theory of organization must be capable of reflecting a company's many facets, its dynamism, and its basic orderliness. When company organization is reviewed, or when reorganizing a company, it must be loked upon as a whole, as a total system.