A Quote by Borje Ekholm

In my experience over the past 30 years in business, investment decisions can be slowed or stopped due to unpredictability in laws and regulatory framework or if free trade and competition is hampered or access to capital restricted.

Related Quotes

The Transatlantic and Transpacific Trade and Investment Partnerships have nothing to do with free trade. 'Free trade' is used as a disguise to hide the power these agreements give to corporations to use lawsuits to overturn sovereign laws of nations that regulate pollution, food safety, GMOs, and minimum wages.

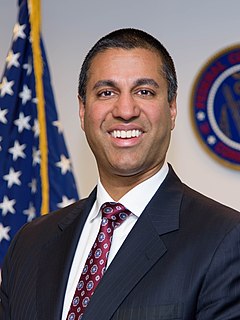

We all agree on the core values of a free and open Internet. We simply may disagree on the appropriate regulatory framework for securing those values. And I would much rather have an open and honest debate about the appropriate regulatory framework as opposed to throwing misinformation out there to achieve political ends.

Fair Trade is a market-based, entrepreneurial response to business as usual: it helps third-word farmers developing direct market access as well as the organizational and management capacity to add value to their products and take them directly to the global market. Direct trade, a fair price, access to capital and local capacity-building, which are the core strategies of this model, have been successfully building farmers' incomes and self-reliance for more than 50 years.

To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What's needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. You must supply the emotional discipline.

A hundred years ago-even 20 or 30 years ago-it was possible, if not always easy, to close major business by calling on and satisfying a key decision-maker. Today, every piece of business entails multiple decisions, and those decisions are virtually never made by the same person. Not only do you have to contend with multiple decisions, but the people who make those decisions may not even work in the same place.

You have to understand your own psychology. You have to understand that human beings weren't really designed to invest. We have all these emotions that are appropriate responses if you're being chased by a tiger, but they're terrible responses if you've got a 30-year time horizon to think about investment or when you're trying to manage investment over 30 years.

Over the long term, it's hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you're not going to make much different than a six percent return - even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you'll end up with one hell of a result.

When it comes to solving problems of poverty, impact investing can act as a catalyst, but it is not a silver bullet. Successful businesses serving the poor need more than investment capital. They also need infrastructure to enable effective distribution, strong regulatory systems, access to markets, technical assistance as they scale up, and more

I ask a simple question. Hillary Clinton has been doing this for 30 years. Why the hell didn't you do it over the last 15, 20 years? And you do have experience. I say the one thing you have over me is experience, but it's bad experience, because what you've done has turned out badly. For 30 years you've been a position to help, and if you say that I use steel or I use something else, make it impossible for me to do that. I wouldn't mind. The problem is you talk but you don't get anything done, Hillary.