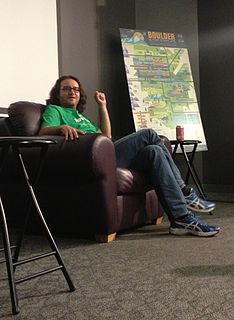

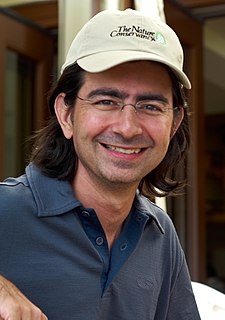

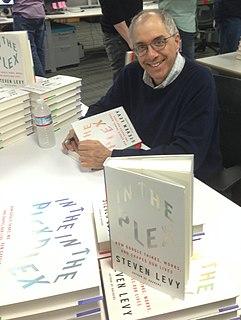

A Quote by Brad Feld

While I'm a venture capitalist who invests in early-stage tech companies, I often feel like a professional emailer and conference call maker.

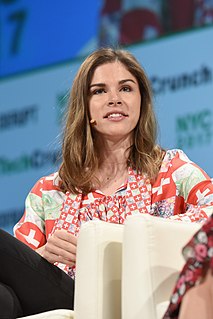

Related Quotes

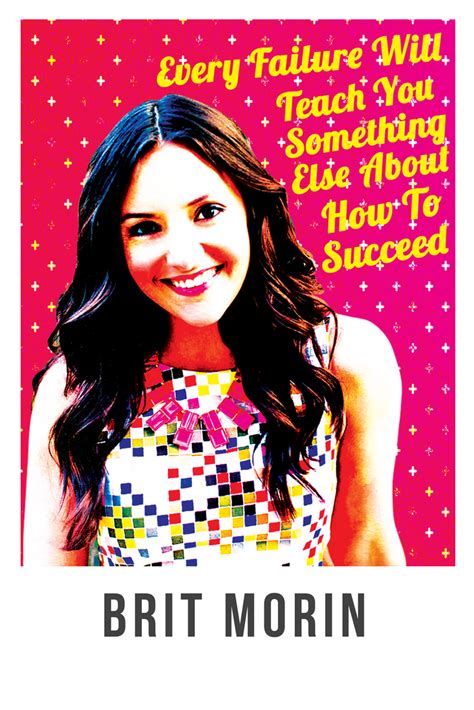

While it's true that women are the minority in most tech companies, I don't think that inhibits entry into the tech space. My motto has always been, 'Live What You Love,' and as such, I think it's incredibly important to do work you believe in and to work for a company that has values that align with your own, be it in tech or another industry.