A Quote by Brendon Small

Marriage is only good for two things: tax breaks and adultery.

Quote Topics

Related Quotes

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

Adultery is the vice of equivocation.

It is not marriage but a mockery of it, a merging that mixes love and dread together like jackstraws. There is no understanding of contentment in adultery.... You belong to each other in what together you've made of a third identity that almost immediately cancels your own. There is a law in art that proves it. Two colors are proven complimentary only when forming that most desolate of all colors--neutral gray.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

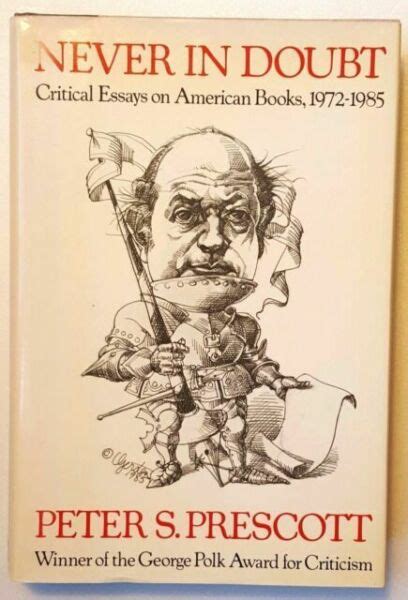

You don't read Gatsby, I said, to learn whether adultery is good or bad but to learn about how complicated issues such as adultery and fidelity and marriage are. A great novel heightens your senses and sensitivity to the complexities of life and of individuals, and prevents you from the self-righteousness that sees morality in fixed formulas about good and evil.

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

If we choose to keep those tax breaks for millionaires and billionaires, if we choose to keep a tax break for corporate jet owners, if we choose to keep tax breaks for oil and gas companies that are making hundreds of billions of dollars, then that means we've got to cut some kids off from getting a college scholarship.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

The intimate coupling of two men or two women is not marriage. It is a pale and misshapen counterfeit that will only serve to empty marriage of its meaning and destroy the institution that is the keystone in the arch of civilization... Marriage is the sine qua non for healthy children and a stable society. It is 'fundamental to the very existence and survival of the race.'