A Quote by Brian Armstrong

I do think some digital currency will end up being the reserve currency of the world. I see a path where that's going to happen.

Related Quotes

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

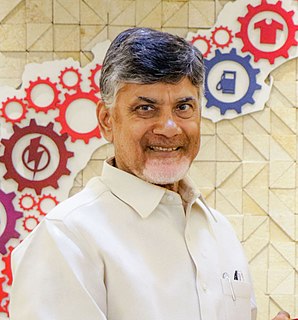

The regulator banned cryptocurrency... then there was an order from the Supreme Court. So, in the absence of any strong law, it was very important for us to come out with a comprehensive law-one for the private digital currency and second for the government for its digital form of currency, or the virtual currency.

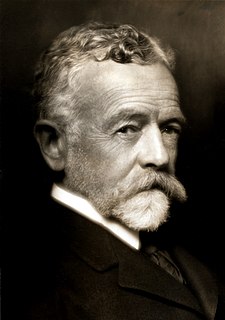

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.