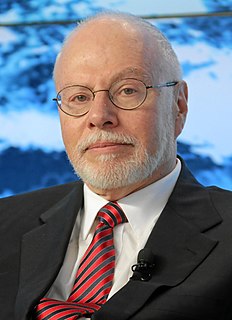

A Quote by Brock Pierce

Security tokens are going to give birth to a quadrillion dollar market. This is because we will see the tokenization of the world's fiat money, debt market, real estate, equities, and art.

Related Quotes

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

What went wrong is we had tremendous concentration in the sense we put a lot of our money to work against U.S. real estate. We got here by lending money, and putting money to work in the U.S. real estate market, in a size that was probably larger than what we ought to have done on a diversification basis.

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.

Today the strategies of many companies in the real estate industry are premised on low interest rates, an assumption that has resulted in the rapid expansion of the real estate securitization business. This trend could be regarded as a risk factor, as it exposes the real estate sector to at least three potential problems: first, interest rate hikes; second, revisions to securitization business accounting standards; and third, overheating in the real estate market.

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.